About the Project

Objectives

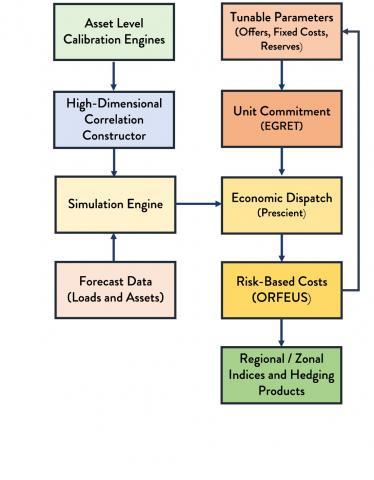

Modern electricity markets face new sources of risk as renewables footprint increases, and price formation in the traditional sense will ultimately be subordinated to reliability quantification. The ORFEUS platform ascribes risk and costs to each asset’s contribution to system operational cost. Its major components include:

- Nodal load and generation scenarios

- Analysis of system operation costs

- Risk allocation and construction of system risk indices

- Securitization and risk transfer

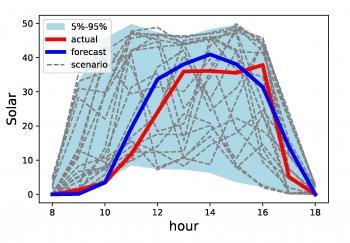

A Stochastic Model Capturing Correlations

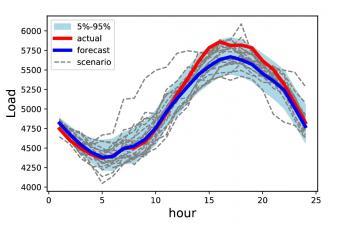

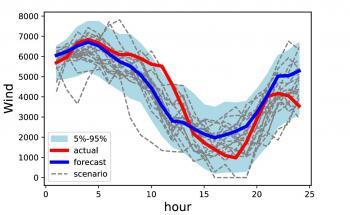

Renewable energy resources reduce carbon footprint and marginal cost, but also introduce risk to the grid that is not fully accounted for under current operational paradigms. The fulcrum of the ORFEUS platform is a set of asset-specific modules which calibrate stochastic models of the joint behavior of forecasted and actual production, tailored to wind, solar and load. Models are linked through a highdimensional correlation constructor which renders spatial and temporal correlation structure tractable via LASSO-based methods and parametric representations of locational correlation structure (Gaussian Random Fields). The last figure shows examples of graphical LASSO correlation effects for NYISO and ERCOT zonal load forecast errors.

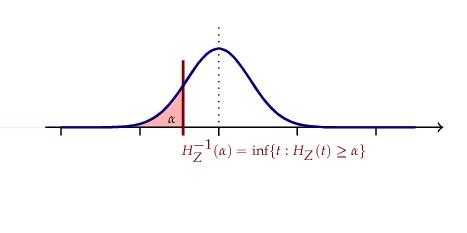

Financial Risk Measures Reliability Indices

Zero-marginal-cost assets are usually guaranteed to be committed even if they create potentially costly externalities due to uncertain production. The ORFEUS risk-based cost module rigorously decomposes the results of the simulation batch into reliability costs by asset and zone using coherent risk measure methodologies ensuring that system operations allocate realized costs equitably.

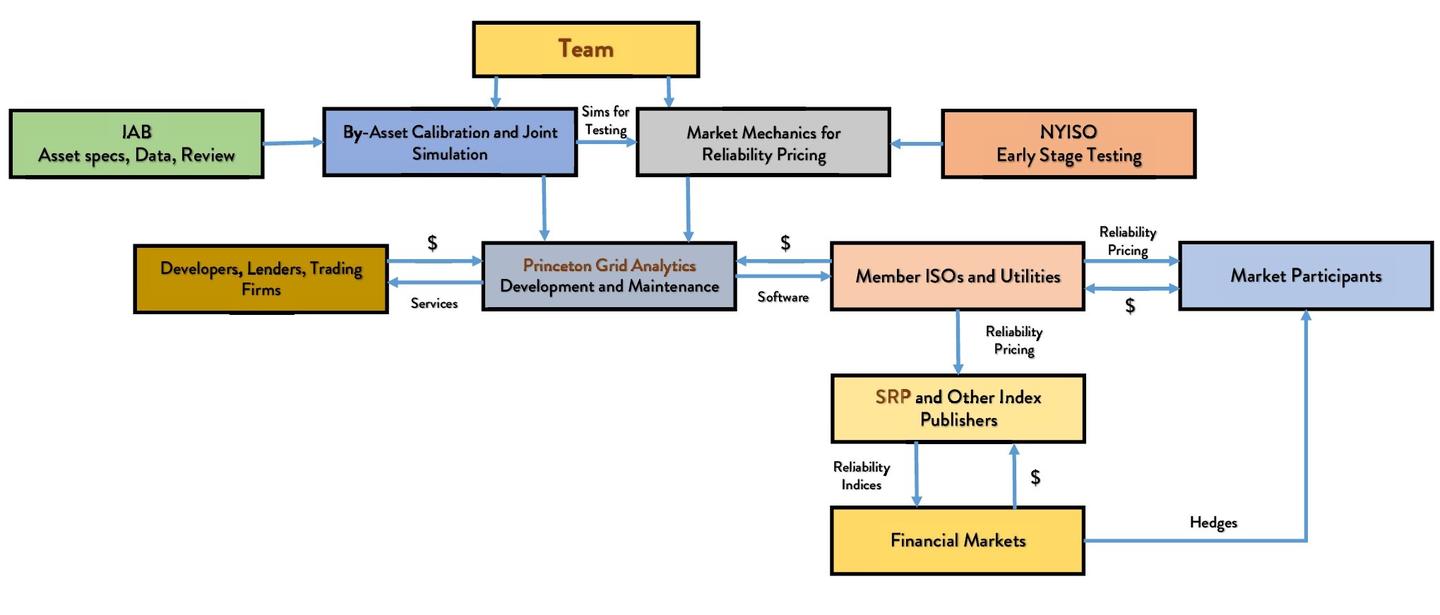

Transition to Market and Pilot

The ORFEUS team and Industry Advisory Board are well-positioned to deploy and test the platform in production settings, ultimately launching Princeton Grid Analytics as the commercial delivery vehicle.

Contact

General inquiries welcome.